|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding Chapter 7 Bankruptcy MN: A Comprehensive Guide

Chapter 7 bankruptcy in Minnesota is a legal process that allows individuals to discharge their debts and start anew. This guide will explore the various aspects of Chapter 7 bankruptcy, focusing on the specific considerations for residents of Minnesota.

What is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy, often referred to as 'liquidation bankruptcy,' involves the sale of a debtor's non-exempt assets to pay off creditors. It is a solution for those who are unable to repay their debts, providing a fresh financial start.

Eligibility Criteria

Means Test

To qualify for Chapter 7 bankruptcy in Minnesota, you must pass a means test, which compares your income to the median income for a similar household size in the state. This ensures that only those who truly cannot pay their debts are eligible.

Credit Counseling

Before filing, you must undergo credit counseling from an approved agency to explore alternative solutions.

The Filing Process

Filing for Chapter 7 bankruptcy involves several steps, including submitting a petition, listing all assets and liabilities, and attending a meeting with creditors.

Key Documents

- Bankruptcy Petition

- Schedules of Assets and Liabilities

- Statement of Financial Affairs

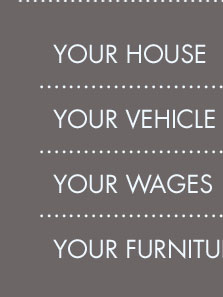

Exemptions in Minnesota

Minnesota offers specific exemptions that allow you to keep certain assets, such as your home and car, up to a certain value. This is crucial for maintaining stability post-bankruptcy.

FAQs About Chapter 7 Bankruptcy in MN

What debts can be discharged?

Most unsecured debts, like credit card debt and medical bills, can be discharged. However, some debts, like student loans and child support, are typically non-dischargeable.

How long does the Chapter 7 process take?

The process usually takes about four to six months from the filing date to the discharge of debts.

Can I keep my home?

If your home equity is within Minnesota's exemption limit, you may be able to keep it. Otherwise, it might be sold to pay creditors.

What is the role of a trustee?

The trustee administers the bankruptcy case, including the liquidation of non-exempt assets and distribution to creditors.

Comparing Chapter 7 and Chapter 13 Bankruptcy

While Chapter 7 involves asset liquidation, Chapter 7 and Chapter 13 bankruptcy differ in that Chapter 13 focuses on reorganization and creating a repayment plan.

Important Considerations for Minnesotans

Residents of Minnesota should be aware of state-specific laws that may impact their filing. Consulting a local attorney can provide guidance tailored to individual circumstances.

For those outside of Minnesota, such as in chapter 7 bankruptcy Arkansas, the process and exemptions might differ, emphasizing the importance of understanding local regulations.

In a Chapter 7 Bankruptcy, any non-exempt assets you have are liquidated by the Chapter 7 trustee. The proceeds are then used to pay toward your debts. To the ...

Chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt.

In Minnesota, it takes approximately 4 months to complete a Chapter 7 Bankruptcy. An experienced Minnesota bankruptcy lawyer can make sure all the steps are ...

![]()